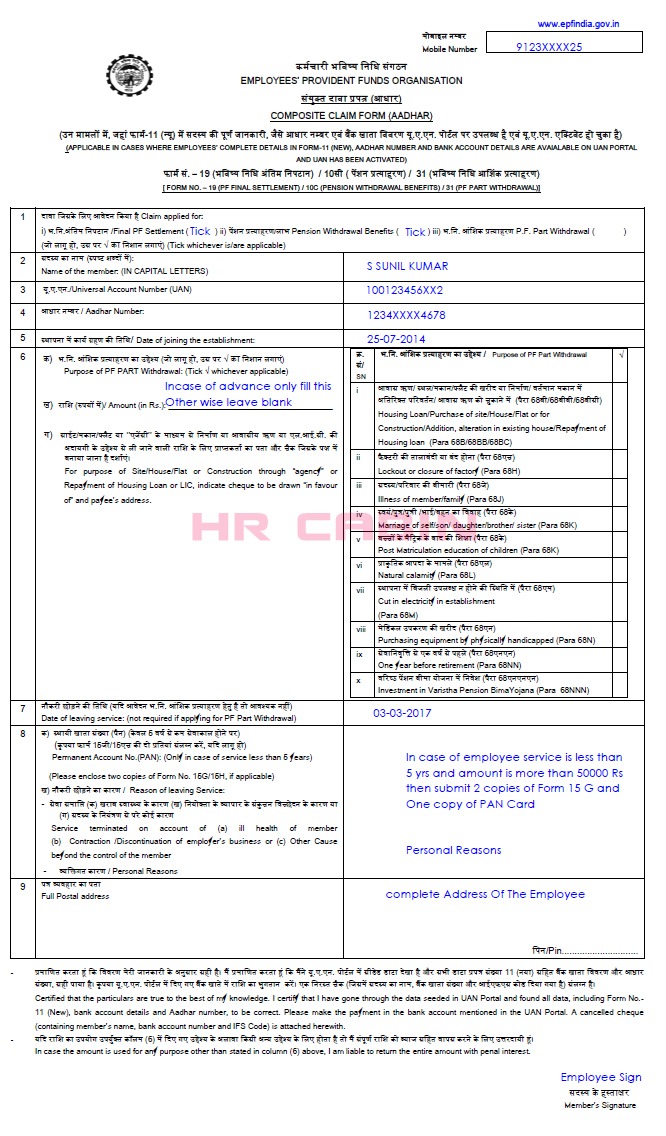

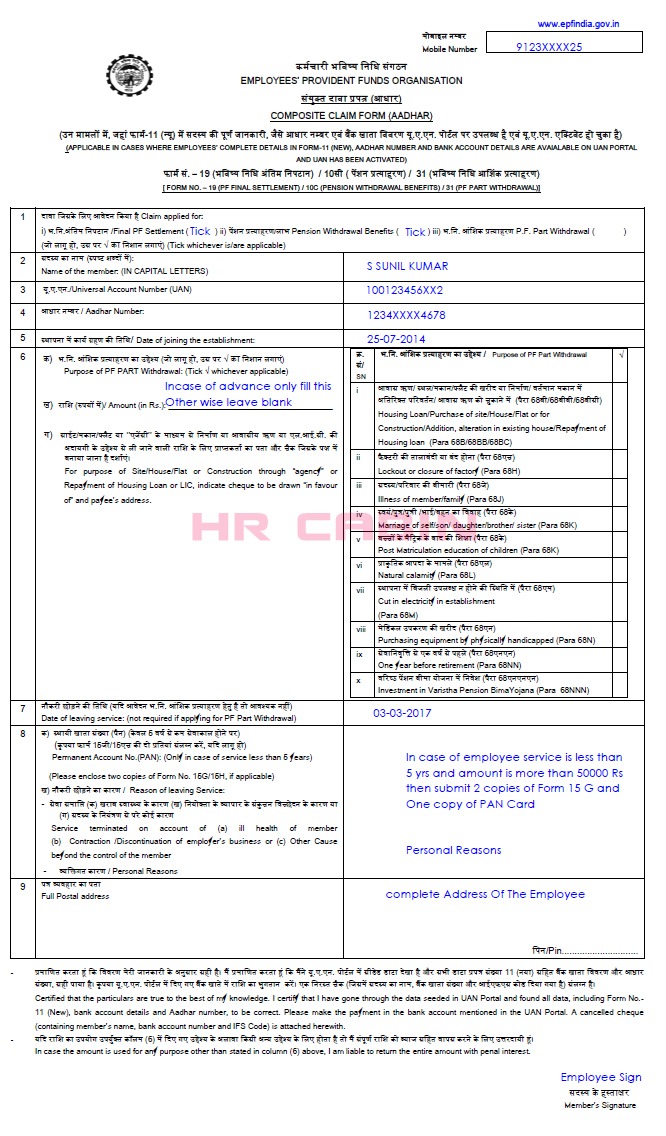

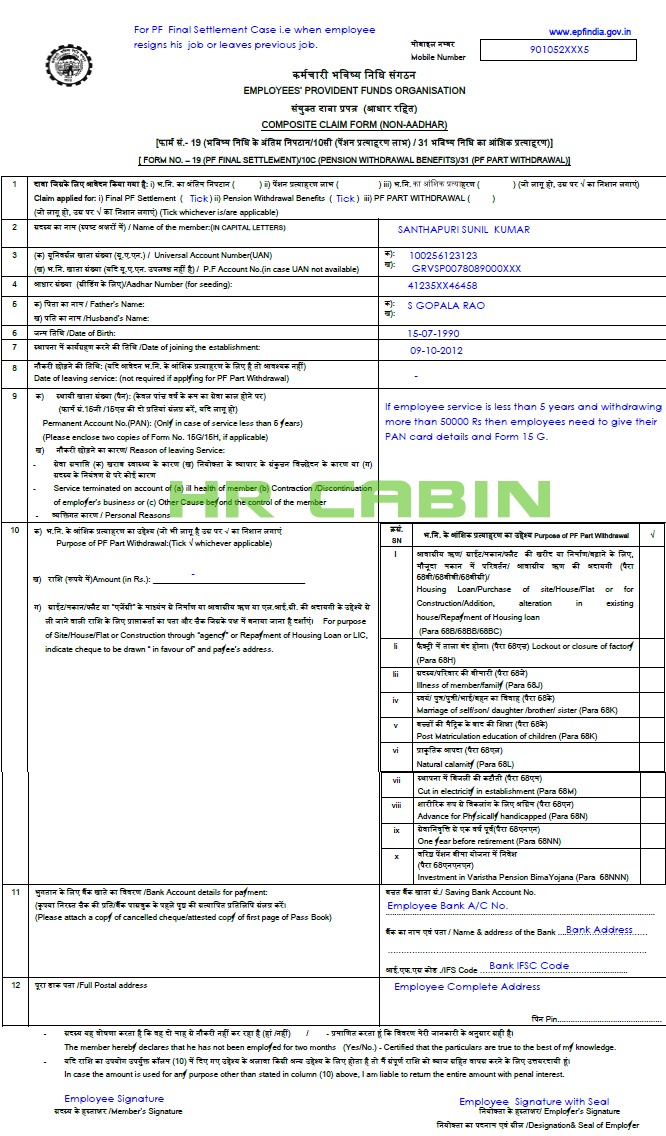

EPF composite claim forms Aadhar and Non-Aadhar are used to claim PF amount, pension amount, and PF advance amount. Composite claim forms are the replacement of PF forms like PF form 19, PF form 10C, and PF form 31.

Earlier all PF members needed to fill three types of forms for PF and pension withdrawal, for example, form 19 for PF amount withdrawal, form 10c for pension withdrawal before 10 years of service, form 31 to withdraw the advance amount from PF.

EPF composite claim form non aadhar needs to be submitted when employee KYC details are not updated with their UAN number.

I have applied for Form-19 (EPF Withdrawal) Form Online for my client’s case. Now I want to apply for Form-10C for Pension Withdrawal, But I am not able to apply online Form some error messages reflecting as ” TOTAL SERVICE IS GREATER THAN OR EQUAL TO 9.5 YEAR OR SERVICE LENGTH IS LESS THAN 6 MONTHS”. My client joined the organization on 18/10/2012 and left the organization on 30/06/2022. client has not attained 58 years as of date. So kindly guide me on how to Withdraw the Pension Amount left in the UAN Account Reply

As his service is above 9.5 years, he cannot withdraw his pension now, either he can get pension scheme certificate or continue the EPF scheme whenever he joins a new job.

He will get the monthly pension after 58 years of age. Reply

Hi Shravan Kumar Singh first claim your previous PF account with the above procedure.once you can continue or withdraw present PF account Reply

I resigned from my job in 6th Sep-2019 and I want to withdraw my total PF amount.

i joined new company 10 september 2019 pf no defer but uan 1

please help me get back pf old company. Reply

Hi Sir, I am facing financial challenges, I have total 5 companies pf accounts , I need to withdraw total pf amount from 5 companies with one UAN number and and should not continue pf transefer to the current comany, Please suggest me what is the process to do not transefer the previous pf ammount to the subsequesnt company pf account. Thanks in advance Reply

Without transfer you cannot withdraw your total PF amount, you can withdraw only partial amounts from each of your PF accounts as a PF advance, so better try to transfer all your previous PF amounts to your last PF account. Reply

Abhijit MondalHi, I have transfer my previous 2 company pf balance to my current account under a UAN but pension amount not transfer so how can do I withdrawl my pension balance, pls help me.. Regards

Abhijit Mondal Reply

Dear Sir I resign My job in Feb 2-2018 and I want to withdraw my total PF amount. I joined company in 6 Nov 2006. I have 2 PF accounts and 1 UAN number . I want with Draw my non UAN PF amount . What is process and witch forms I can submit for non UAN PF amount withdraw Reply

Avinash SurjuseHi, My spouse has expired and I want to claim the pf online. what needs to be done. I went to pf office thrice but I could not get any suggestion from them. I need to fill the Composite form online or offline and what is the procedure. I have login uan id and password , but could able to understand what to do. Please guide me. Reply

Hi Avinash Sujuse,

You need to submit form 20, 10D depending upon the service period of your wife. You can download suitable form from this link https://www.epfindia.gov.in/site_en/WhichClaimForm.php#Q5 Reply

Hi, Thanks for detail information. Can you please confirm after filling this Composite form Adhaar, which PF office we need to submit it. Thanks! Reply

Hi Meenakshi Kumari,

You can find your PF office branch name on your PF passbook, or you can also ask your employer. Reply

Dear Sir I resign My job in Dec-2018 and I want to withdraw my total PF amount. I joined company in 2007 in off rolls and in I got promotion in 2011 (on rolls ) . I have 2 PF accounts and 1 UAN number . In Off rolls 2007 to 2011 -4 years 4 months In On rolls 2011 to 2018 – 7 years 6 Months . total -11 years 10 Months – I resign in Dec-2018 I want with Draw total PF amount . What is process and witch forms I can submit for 2 PF amount withdraw Reply

Hi.

My actual date of leving previous company is X SEP 2017 and joining new company was in OCT 2017. But previous company has updated DOE as X AUG 2018. And so am unable to merge previous and current companies PF amount. Regarding this I have raised grevanc and I was asked to submit Composite Claim Form along with 2 copies of form 15G and a canceled cheque for settlement of previous companies PF amount.

So what I want to know is. Is this process going to work for withdrawal of previous companies PF amount.?

Please let me know and advice if any better solution is available.. Reply

Hi Rehan,

First, claim your previous PF account with the above procedure, once you get the previous claim amount then you can continue or withdraw present PF account. Reply