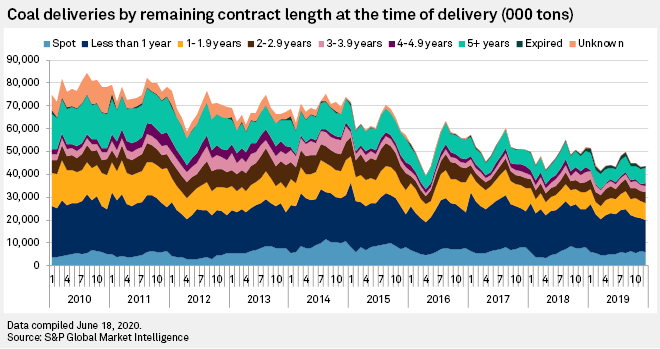

While longer-term deals still form a smaller share of coal deliveries to U.S. power plants, companies recently delivered a higher share of coal on medium-term contracts with terms of two to four years remaining, according to a recent snapshot of the market analyzed by S&P Global Market Intelligence.

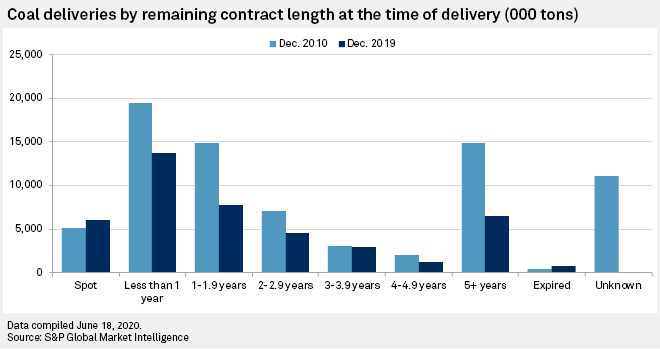

About 17.2% of coal delivered to U.S. power plants in December 2019 had two to four years remaining on the contract, up from 13.0% in December 2010. Producers delivered 14.8% of the coal sold in the country under agreements with more than five years left on the contract, down from 19.1% in December 2010. At the same time, coal volumes sold on spot contracts rose from 6.6% in December 2010 to 13.9% in 2019.

Longer-term contracts offer coal producers the relative stability needed to make capital decisions around output and convince investors of future profitability. With an abundance of cheap gas and coal in the U.S. in recent years, however, many utilities have fewer reasons to worry about needing to lock in cheap fuel through long-term coal contracts.

"We expect to continue selling a significant portion of coal production from our U.S. thermal mining segments under long-term supply agreements, and customers of those segments generally favor long-term sales agreements in recognition of the importance of reliability, service and predictable coal prices to their operations," Peabody Energy Corp., the largest coal mining company by volume in the U.S., explained in its 2019 annual report released in February.

The terms of coal supply agreements can vary substantially and result from competitive bidding and negotiations with customers. Peabody noted that contracts in the sector often contain price adjustment features, price reopener terms, coal quality requirements, quantity parameters, permitted sources of supply, treatment of environmental constraints, extension options, force majeure, and termination and assignment provisions.

"Most of our sales are made under coal supply agreements, which are important to the stability and profitability of our operations," Peabody wrote in the report. "The execution of a satisfactory coal supply agreement is frequently the basis on which we undertake the development of coal reserves required to be supplied under the contract, particularly in the U.S."

Consol Energy Inc., a company that regularly touts its contracted position with utilities selected for their longevity in a market where coal retirements are relatively regular, recently said it was identifying "creative solutions" to help its customers navigate the "extremely challenging situation" presented by the COVID-19 pandemic and other headwinds. On a May 11 earnings call, CEO Jimmy Brock said the company completed several contract buyouts during the first quarter, realizing $10.8 million in miscellaneous income as it negotiated several early terminations.

"While we are mostly contracting for 2020, we have some more work to do for our volumes in 2021 and beyond," Brock said. "Despite our strong contracted position, we do face significant uncertainties given the unpredictable nature of the COVID-19 pandemic and the resulting economic slowdown."

Alliance Resource Partners LP is also working with its coal buyers, who have indicated "a willingness and a desire to take at the minimum levels of our contracts," Alliance CEO Joseph Craft noted during a recent earnings call. The company announced that it would reduce production to match existing contracted sales commitments for the year, dropping its 2020 guidance by about 25% to 30% to a range of 27 million to 28 million tons.

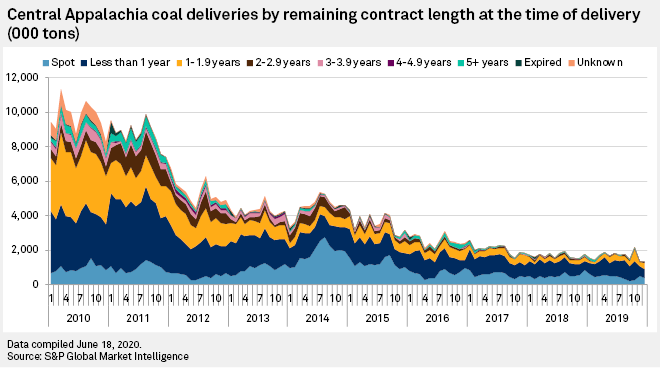

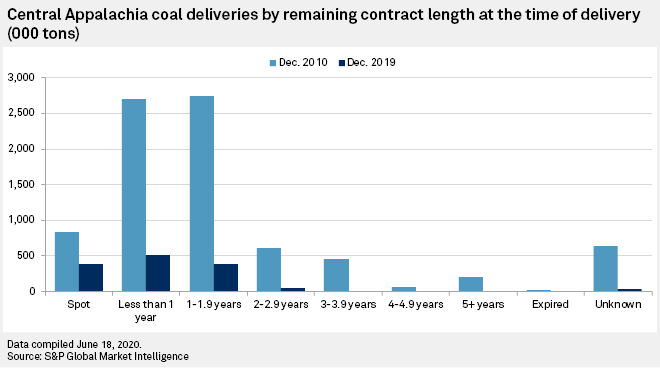

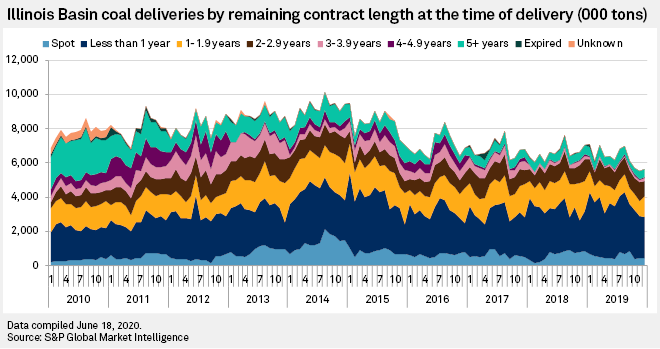

Contract length trends vary by the coal-producing region where utilities source the fuel.

In Central Appalachia, where producers increasingly focus on export markets and metallurgical coal production, long-term contracts are quickly going by the wayside. According to the analysis, which is based on federal fuel contract data from the U.S. Energy Information Administration, coal delivered to U.S. utilities on contracts of a known length in December 2019 all had less than three years remaining on their term. The bulk of coal delivered to U.S. power plants from the region were sold on spot markets or under contracts with terms lasting less than a year.

In the Illinois Basin, where coal sales to domestic power producers have held flatter in recent years, spot sales have increased from 6.6% of sales to 13.9% of sales as of the December 2019 delivery date. The amount of coal delivered on contracts with more than five years remaining fell from 19.1% of coal sold to U.S. utilities to 14.8%. Simultaneously, the percentage of coal sold on contracts with two to five years remaining on the contract increased slightly.

In the Powder River Basin, the total volume of coal delivered under a contract in December 2019 decreased in every contract length category except for spot sales and deliveries made based on contracts that had already expired. Deals with less than a year remaining on their term made up 38.9% of the coal delivered from the basin in December 2019.